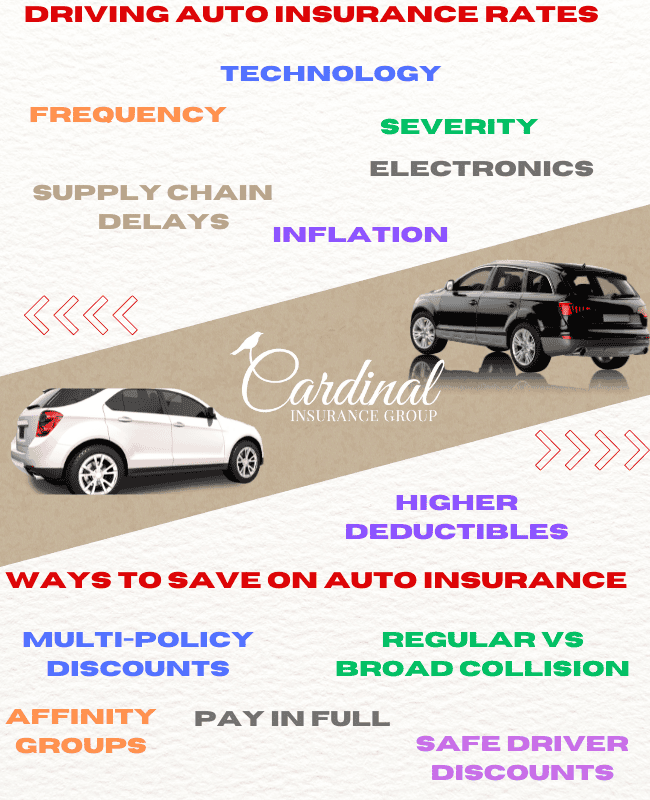

On average, the cost for personal auto insurance in the US rose 20.6% over 2023 costs, which was also up an average of 17.4% from 2022. We all know that inflation is hitting all industries and that includes Michigan auto insurance premiums.

Increases in auto insurance costs this year are due to a rise in the number of auto accidents, the severity of those accidents, and the drastic increase in the cost of replacement parts for vehicles that are far more advanced than ever.

Some of the accident severity is said to have stemmed from the pandemic when drivers were speeding more often and driving through intersections due to there being fewer drivers on the road. In fact The New York Times reported earlier this year that seat belt use is down and that we had a historic high of intoxicated driving arrests, both of which are increasing accident and fatality costs along with medical bills.

Vehicles are also becoming much more expensive to repair in 2024. Due to the modern electronics that are now installed on vehicles such as back-up cameras, telematics, and carputers, the average fender bender now costs more than $4,700 to repair damages, whereas a few years ago it was about half of that.

We strongly believe it’s still in your best interest to look at several insurance companies to make sure you are getting the best value for your insurance budget. We happen to be biased and believe that choosing an Independent Agent is your best option because we can shop a number of companies for you.