It can be incredibly frustrating to purchase a home insurance policy and then be told after years of paying premiums, that your claim has been denied. In fact, for many of us, it would be infuriating if we thought whatever happened was or should be covered under our policy.

Why does this happen? As a Michigan independent agency writing thousands of home insurance policies over the years, it’s important for our clients to understand why this happens, and preferably prior to a claim being submitted.

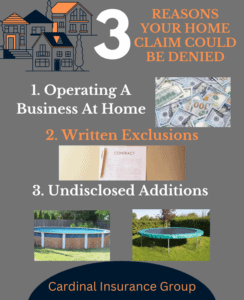

There are several reasons why home insurance companies might deny coverage. One reason is home insurance exclusions. Exclusions are specific circumstances that are written out in full detail in your policy language. They are specifically addressed as not being covered by your home insurance policy. If your claim falls into one of these excluded categories, your home insurance company can, and usually will, deny your claim. An example of an exclusion found in home insurance policies is wear and tear. Companies are not in business to perform maintenance on your home, so replacing worn roofs or siding are not the responsibility of your insurance company.

Another reason for home insurance claim denial is gaps in coverage. Gaps can occur if you have made recent changes to your home that aren’t covered by your existing home insurance policy, such as adding a large deck and gazebo that you didn’t advise your agent about. Gaps in coverage can also occur if you have a home-based business or if you rent out part of your home, again without consulting with your insurance agent.

Home insurance policies were written to protect a property that was being used as a principal residence by the named insured. When that changes, perhaps you sell the home under land contract, and don’t tell us, or rent it out all year long, or allow another family member to live there (even if rent free), these living situations void the contract that was written rated on it being YOUR primary residence.

Why? Because someone else living in your home doesn’t have the financial interest in it to make sure that it’s properly taken care of. Also because someone else living there can sue you for the property’s condition or exposures such as a swimming pool, old weakening deck that collapses.

These are just some of the common scenarios where we see claims being denied. If your home insurance company denies your claim, it’s important to understand why. Once you know the reason for the denial, you can take steps to appeal the decision or make sure that future claims are more likely to be covered by altering or changing the type of insurance you are paying for.

Discussing common exclusions and finding a consultative agent who can educate you on coverage options and their costs, can help prevent many claim denials from happening on things that can in fact be included in your home insurance protection.