You paid for your full year of business insurance, so why are you now getting a bill, and what is an audit anyway?

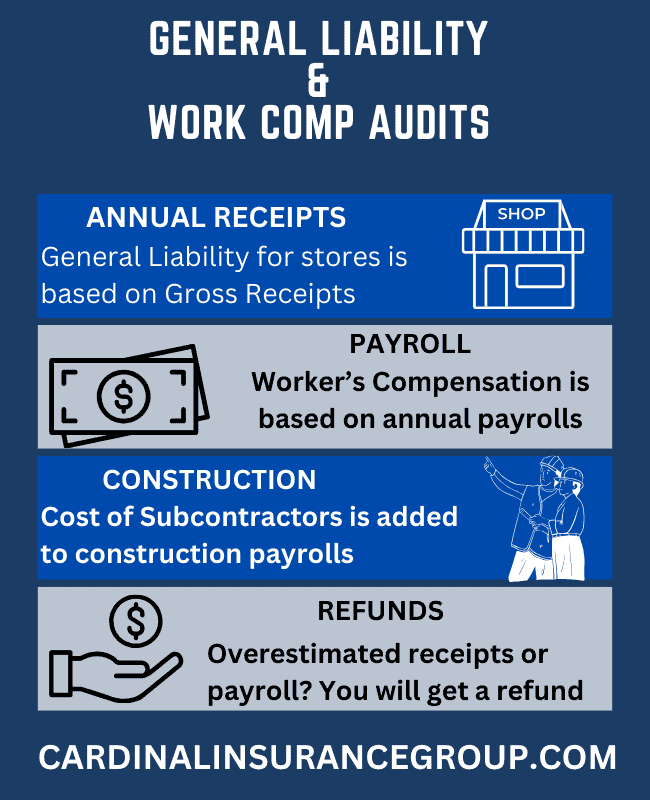

An audit is a process where the insurance company reviews payroll and receipts to make sure you are paying the correct premium according to the exposure your business has. It’s a checks and balance system to ensure that you are charged correctly.

General liability insurance if based on receipts, as well as workers compensation, are policies that can be audited annually. You provide the receipts and payroll that you believe you will have for the 12 months going forward, and if you underestimate, you will owe more premium. However, if you over estimated, you will get a refund. We don’t get clients calling about audit refunds like we do about audit bills, but it’s a fair system to charge based on your business’s actual exposure.

Audits also verify employee classifications. Classification is important because different types of jobs have different levels of risk for the company. An office worker will not have the same exposure to be injured or killed as a roofer does. For workers compensation insurance, the higher the risk of injury or death, the higher the premium.

To prepare for a liability or work comp audit, we suggest you review employee classification codes, gather payroll and receipt records for the past year, and make sure you have job descriptions and safety records on hand.

Being prepared and having these conversations with your agent can help prevent the majority of audit issues before they occur.